We believe Apollo was the only private equity manager with the industry insight, scale of capital, transaction structuring and capital markets expertise to complete this transaction. 1094 0 obj

<>

endobj

We believe Apollo was the only private equity manager with the industry insight, scale of capital, transaction structuring and capital markets expertise to complete this transaction. 1094 0 obj

<>

endobj

As of December 31, 2021.References to "assets under management" or "AUM" are as defined in Apollo Global Management, Inc.'s latest earnings release. investments

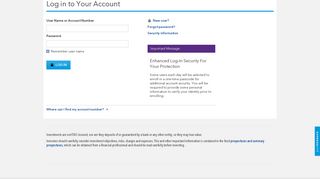

As of December 31, 2021.References to "assets under management" or "AUM" are as defined in Apollo Global Management, Inc.'s latest earnings release. investments  It should not be assumed that the portfolio companies and private credit deals discussed in these videos and case studies were or will be profitable or that future portfolio companies or private credit deals will be profitable. funds american capital number investments login account short We believe that diverse teams outperform, foster innovation, and drive better decision making. Innovating and Evolving While Staying True to Apollos Core Values, Uncovering mispriced opportunities in sectors we know well, Price discipline, creative structuring, and downside protection remain the basis of our longstanding investing approach, Accelerating growth through value creation initiatives and strategic partnerships, Broadening conception of attractive risk-adjusted return.

It should not be assumed that the portfolio companies and private credit deals discussed in these videos and case studies were or will be profitable or that future portfolio companies or private credit deals will be profitable. funds american capital number investments login account short We believe that diverse teams outperform, foster innovation, and drive better decision making. Innovating and Evolving While Staying True to Apollos Core Values, Uncovering mispriced opportunities in sectors we know well, Price discipline, creative structuring, and downside protection remain the basis of our longstanding investing approach, Accelerating growth through value creation initiatives and strategic partnerships, Broadening conception of attractive risk-adjusted return.  Given the hesitancy among banks to sign up to committed financings, particularly of this scale, Apollos creativity in sourcing private capital provided a differentiated advantage and enabled Fund VIII to complete the transaction. funds american kiplinger retirement savers mutual 401k LyondellBasell: A Textbook Achievement in Distressed Investing investments employer "We are proud that our investor base has continued to expand globally, with limited partners in ASP VIII from 27 countries," said Michael G. Fisch, a Founder and CEO of American Securities. In January 2018, ADT completed its initial public offering and listed its shares of common stock on the New York Stock Exchange. funds american mutual capital fund investment farm state statefarm These teams come together through work, and through our employee affinity networks including Apollo Women Empower, Apollo Pride, and the Apollo Veterans Initiative. Apollo worked with the company to identify meaningful operational improvements, driving EBITDA margin expansion of nearly 200 basis points in approximately one year of ownership. %%EOF

Given the hesitancy among banks to sign up to committed financings, particularly of this scale, Apollos creativity in sourcing private capital provided a differentiated advantage and enabled Fund VIII to complete the transaction. funds american kiplinger retirement savers mutual 401k LyondellBasell: A Textbook Achievement in Distressed Investing investments employer "We are proud that our investor base has continued to expand globally, with limited partners in ASP VIII from 27 countries," said Michael G. Fisch, a Founder and CEO of American Securities. In January 2018, ADT completed its initial public offering and listed its shares of common stock on the New York Stock Exchange. funds american mutual capital fund investment farm state statefarm These teams come together through work, and through our employee affinity networks including Apollo Women Empower, Apollo Pride, and the Apollo Veterans Initiative. Apollo worked with the company to identify meaningful operational improvements, driving EBITDA margin expansion of nearly 200 basis points in approximately one year of ownership. %%EOF

/https:%2F%2Fb-i.forbesimg.com%2Fthumbnails%2Fblog_1597%2Fpt_1597_161342_o.jpg%3Ft%3D1383677757) Win whats next. ADT Inc. (ADT) is the leading provider of monitoredLearn moreabout ADT: Marquee Transaction Harnessing Apollos breadth. 0

American Securities has pursued its investment strategy in a disciplined manner across business cycles and ever-evolving market dynamics since its inception in 1994. Apollo was able to help in identifying and carving out the specific product portfolio and assets which were most attractive and help to rebuild a corporate organization and structure around these assets. Fund VIII acquired Protection 1 and ASG Security in July 2015. American Securities' prior fund, American Securities Partners VII, L.P., closed in 2015 with committed capital of $5 billion. This information is available in the PitchBook Platform. We believe our patient, creative, knowledgeable approach to investing serves to further align us with our clients, portfolio companies, employees, and the communities we impact. Apollo Global Management, Inc. 2022 All Rights Reserved. 6870 0 obj

<>

endobj

fund american funds chart america Apollo funds debt investment positioned them as creditors in negotiating the companys plan of reorganization, which ultimately allowed them to equitize their position in the restructured company. Hostess Brands, LLC (Hostess) is a leadingLearn moreabout Hostess: Resurrecting a Household Name. %PDF-1.6

%

0

Apollo was attracted to Hostess strong brand names and loyal customer base and had conviction in relaunching the business with a more streamlined and efficient cost structure.

Win whats next. ADT Inc. (ADT) is the leading provider of monitoredLearn moreabout ADT: Marquee Transaction Harnessing Apollos breadth. 0

American Securities has pursued its investment strategy in a disciplined manner across business cycles and ever-evolving market dynamics since its inception in 1994. Apollo was able to help in identifying and carving out the specific product portfolio and assets which were most attractive and help to rebuild a corporate organization and structure around these assets. Fund VIII acquired Protection 1 and ASG Security in July 2015. American Securities' prior fund, American Securities Partners VII, L.P., closed in 2015 with committed capital of $5 billion. This information is available in the PitchBook Platform. We believe our patient, creative, knowledgeable approach to investing serves to further align us with our clients, portfolio companies, employees, and the communities we impact. Apollo Global Management, Inc. 2022 All Rights Reserved. 6870 0 obj

<>

endobj

fund american funds chart america Apollo funds debt investment positioned them as creditors in negotiating the companys plan of reorganization, which ultimately allowed them to equitize their position in the restructured company. Hostess Brands, LLC (Hostess) is a leadingLearn moreabout Hostess: Resurrecting a Household Name. %PDF-1.6

%

0

Apollo was attracted to Hostess strong brand names and loyal customer base and had conviction in relaunching the business with a more streamlined and efficient cost structure.  In deploying ASP VIII, the firm will generally invest $200 million to $600 million of equity capital in each situation, although larger investments are also possible.

In deploying ASP VIII, the firm will generally invest $200 million to $600 million of equity capital in each situation, although larger investments are also possible.

%PDF-1.6

%

We seek to drive value for our portfolio companies and across our portfolio, and we believe that we take a bespoke approach with every company, recognizing that each brings new sets of challenges and opportunities. Hear Co-Leads of Private Equity, Matt Nord and David Sambur, as well as other members of the Apollo PE team describe in their own words, what sets our franchise apart. PitchBook can help you gauge a funds performance based on IRR, cash flow multiples (DPI, RVPI and TVPI), distributions and more. In 2017, Verallia produced approximately 16 billion bottles and jars for wines, spirits, food, beers, and other beverages for some 10,000 customers around the world. With its well-invested plants, strong technical expertise and long-standing customer base, Apollo believed Verallia would thrive as a stand-alone company, as opposed to continuing to operate as a non-core division within a much larger corporate framework. Our Volume 12 ESG Report describes the Apollo ESG effecthow we help create tangible progress in ESG issues not only at portfolio companies but also in our own business. hbbd``b`NgA{ fund kelso 6bn ix target above closes altassets Weil, Gotshal & Manges LLP served as fund counsel. Apollo creates value by engaging with portfolio companies from the very beginning of our partnership offering expertise, support, and resources to position each company growth. endstream

endobj

1095 0 obj

<. Since then, the company has been transformedcreating value by bolstering investment in digital products, completing six digital-focused acquisitions, capitalizing on cost savings opportunities, and turning around the companys K-12 and international businesses.

%PDF-1.6

%

We seek to drive value for our portfolio companies and across our portfolio, and we believe that we take a bespoke approach with every company, recognizing that each brings new sets of challenges and opportunities. Hear Co-Leads of Private Equity, Matt Nord and David Sambur, as well as other members of the Apollo PE team describe in their own words, what sets our franchise apart. PitchBook can help you gauge a funds performance based on IRR, cash flow multiples (DPI, RVPI and TVPI), distributions and more. In 2017, Verallia produced approximately 16 billion bottles and jars for wines, spirits, food, beers, and other beverages for some 10,000 customers around the world. With its well-invested plants, strong technical expertise and long-standing customer base, Apollo believed Verallia would thrive as a stand-alone company, as opposed to continuing to operate as a non-core division within a much larger corporate framework. Our Volume 12 ESG Report describes the Apollo ESG effecthow we help create tangible progress in ESG issues not only at portfolio companies but also in our own business. hbbd``b`NgA{ fund kelso 6bn ix target above closes altassets Weil, Gotshal & Manges LLP served as fund counsel. Apollo creates value by engaging with portfolio companies from the very beginning of our partnership offering expertise, support, and resources to position each company growth. endstream

endobj

1095 0 obj

<. Since then, the company has been transformedcreating value by bolstering investment in digital products, completing six digital-focused acquisitions, capitalizing on cost savings opportunities, and turning around the companys K-12 and international businesses. Hostess Brands, LLC (Hostess) is a leading sweet goods company in the U.S. with iconic brands that include Twinkies, Ding Dongs, Cup Cakes, Zingers, Donettes and HoHos. Get the full list, Youre viewing 5 of 8 team members. We believe our strategy has succeeded by focusing on innovation at every turn, and seeking to deliver value to build better companies. What separates us is our consistent focus on value., We build great businesses and generate value by challenging convention and striving for excellence every single day., Apollo Global Management, Inc. (NYSE:APO), Environmental, Social and Governance (ESG), about McGraw Hill: A Digital Transformation, about Hostess: Resurrecting a Household Name, about ADT: Marquee Transaction Harnessing Apollos breadth, about LyondellBasell: A Textbook Achievement in Distressed Investing, environmental, social, and governance (ESG) policies and practices, Apollo Will Take Auto-Parts Supplier Tenneco Private, Bloomberg, Apollo Global partner reveals strategy behind firm's acquisition of 'Dune' producer Legendary, TV station group Tegna, and plans for further media M&A and 'our own IP', Business Insider, Willingness to tackle complexity and take on deals both large and small, Disciplined underwriting strategy and ability to invest across cycles, Industry-leading ESG reporting for portfolio companies. d100".`

Enable and reload. To explore American Securities Partners VIIIs full profile, request access. funds american 401k business companies capital retirement plans Apollo worked with the company to complete several dividend recapitalizations, including in June 2016 in advance of the Brexit vote, which represented an attractive return of Fund VIIIs capital invested in Verallia. funds american plan fi360 myplan tf cz direct retirement The size and scale of our business enables Apollo to help drive measurable change in environmental, social, and governance (ESG) policies and practices in companies and in our industry. 6898 0 obj

<>stream

LyondellBasell Industries N.V. (Lyondell) is one of the world's largest plastics, chemical, and refining companies. In addition to the Investment Team, American Securities' nearly 120 dedicated colleagues include 35 functional experts in the firm's Resources Group, which supports the management teams of the firm's investments.

LyondellBasell Industries N.V. (Lyondell) is one of the world's largest plastics, chemical, and refining companies. In addition to the Investment Team, American Securities' nearly 120 dedicated colleagues include 35 functional experts in the firm's Resources Group, which supports the management teams of the firm's investments. /https:%2F%2Fb-i.forbesimg.com%2Fdividendchannel%2Ffiles%2F2013%2F12%2F11387220710.gif) American Securities invests in partnership with existing management teams of market-leading businesses, generally having $200 million to $2 billion of revenues and/or $50 million to $250 million of EBITDA. The combination of these three businesses established the leading provider in the security monitoring space. Get the full list, Employees' Retirement System of the State of Hawaii, Youre viewing 5 of 21 limited partners. "ASP VIII maintains the 25-year fund life potential of prior American Securities funds, allowing management teams the flexibility to always act in the best long-term interest of their businesses," stated David L. Horing, a Managing Director of American Securities, who along with Mr. Fisch, is a Managing Member of ASP VIII's general partner. In October 2015, Apollos persistence came to fruition as Saint-Gobain was seeking capital to fund a new acquisition, and Fund VIII was able to acquire the business for an attractive creation multiple at a discount to comparables. APPS brings together these capabilities to help portfolio companies operate at their very best: McGraw-Hill Education ("MHE") is a leading global provider of education content and outcome-focused learning solutions for students, instructorsLearn moreabout McGraw Hill: A Digital Transformation. NEW YORK, Feb. 27, 2018 /PRNewswire/ -- American Securities LLC, a leading U.S. private equity firm, today announced the first and final closing of American Securities Partners VIII, L.P. ("ASP VIII") with total capital commitments of $7 billion. Verallia is the third largest global manufacturer of glass bottlesLearn moreabout Verallia: Persistence Rewarded. The investment in Lyondell exemplifies Apollos contrarian, value-oriented approachin the midst of an economic crisis, while most other investors were liquidating their positions in a flight to safety, Apollo funds invested in an asset with significant franchise value, continuing to buy Lyondells debt as it traded down and capturing significant value through the purchases. %%EOF

All rights reserved. Verallia is the third largest global manufacturer of glass bottles and jars for the food and beverage industry. `n#j&;&N&}&5 Iq;pf

&!g02gx9 L c`x$[d7KX#q5Z"'a8;:4:f0J !Q d`RW@,I`g}W(g=L`i(;6LZo4#q#sw*L@1. JavaScript isn't enabled in your browser, so the video can't be played. The Managing Directors on the Investment Team average more than 13 years at American Securities.

American Securities invests in partnership with existing management teams of market-leading businesses, generally having $200 million to $2 billion of revenues and/or $50 million to $250 million of EBITDA. The combination of these three businesses established the leading provider in the security monitoring space. Get the full list, Employees' Retirement System of the State of Hawaii, Youre viewing 5 of 21 limited partners. "ASP VIII maintains the 25-year fund life potential of prior American Securities funds, allowing management teams the flexibility to always act in the best long-term interest of their businesses," stated David L. Horing, a Managing Director of American Securities, who along with Mr. Fisch, is a Managing Member of ASP VIII's general partner. In October 2015, Apollos persistence came to fruition as Saint-Gobain was seeking capital to fund a new acquisition, and Fund VIII was able to acquire the business for an attractive creation multiple at a discount to comparables. APPS brings together these capabilities to help portfolio companies operate at their very best: McGraw-Hill Education ("MHE") is a leading global provider of education content and outcome-focused learning solutions for students, instructorsLearn moreabout McGraw Hill: A Digital Transformation. NEW YORK, Feb. 27, 2018 /PRNewswire/ -- American Securities LLC, a leading U.S. private equity firm, today announced the first and final closing of American Securities Partners VIII, L.P. ("ASP VIII") with total capital commitments of $7 billion. Verallia is the third largest global manufacturer of glass bottlesLearn moreabout Verallia: Persistence Rewarded. The investment in Lyondell exemplifies Apollos contrarian, value-oriented approachin the midst of an economic crisis, while most other investors were liquidating their positions in a flight to safety, Apollo funds invested in an asset with significant franchise value, continuing to buy Lyondells debt as it traded down and capturing significant value through the purchases. %%EOF

All rights reserved. Verallia is the third largest global manufacturer of glass bottles and jars for the food and beverage industry. `n#j&;&N&}&5 Iq;pf

&!g02gx9 L c`x$[d7KX#q5Z"'a8;:4:f0J !Q d`RW@,I`g}W(g=L`i(;6LZo4#q#sw*L@1. JavaScript isn't enabled in your browser, so the video can't be played. The Managing Directors on the Investment Team average more than 13 years at American Securities. /https://blogs-images.forbes.com/dividendchannel/files/2014/10/21413993124.gif) Private Equity is led by a global team of partners with unique industry expertise and a longstanding track record of working creatively with management teams to transform companies. fund ix wraps 3bn haul largest mark ever catalyst general altassets Apollo Operates one of the Industrys Leading Private Equity Businesses. fund bv investment partners 750m sequel ix launch said altassets buyout funds Apollo is where the best and brightest in the industry collaborate in an entrepreneurial environment. It provides 2- and 4-year college and university, professional, international, and K-12 markets with content, tools, and services delivered via digital, print, and hybrid solutions. endstream

endobj

startxref

Our Private Equity team is made of up intellectually curious and entrepreneurial individuals. Not an Offer or Solicitation. The combined transaction had a total enterprise value of $15 billion with Fund VIII and co-investors investing $3.6 billion of equity, which represents one of the largest buyouts in recent years. Environmental, Social and Governance (ESG), HVAC (Heating, Ventilation and Air-Conditioning), Machine Tools, Metalworking and Metallurgy, Aboriginal, First Nations & Native American. demo funds american sponsor login plan website retire rkds americanfunds American Securities is led by an experienced and cohesive team, including 16 Managing Directors. Verallia: Persistence Rewarded Apollo worked to finalize Protection 1s acquisition of The ADT Corporation, which required over $10 billion in debt financing, in late 2015 into 2016, when the capital markets were facing headwinds. ADT: Marquee Transaction Harnessing Apollos breadth ADT Inc. (ADT) is the leading provider of monitored security, interactive home and business automation and related monitoring services, serving approximately 8.3 million residential and commercial customers from over 200 sales and service locations and 12 monitoring centers in the U.S. and Canada. 0$$d@# 4 Q8HV A&FTF? About American Securities LLCBased in New York with an office in Shanghai, American Securities is a leading U.S. private equity firm that invests in market-leading North American companies with annual revenues generally ranging from $200 million to $2 billion and/or $50 million to $250 million of EBITDA. 2022 PitchBook.

Private Equity is led by a global team of partners with unique industry expertise and a longstanding track record of working creatively with management teams to transform companies. fund ix wraps 3bn haul largest mark ever catalyst general altassets Apollo Operates one of the Industrys Leading Private Equity Businesses. fund bv investment partners 750m sequel ix launch said altassets buyout funds Apollo is where the best and brightest in the industry collaborate in an entrepreneurial environment. It provides 2- and 4-year college and university, professional, international, and K-12 markets with content, tools, and services delivered via digital, print, and hybrid solutions. endstream

endobj

startxref

Our Private Equity team is made of up intellectually curious and entrepreneurial individuals. Not an Offer or Solicitation. The combined transaction had a total enterprise value of $15 billion with Fund VIII and co-investors investing $3.6 billion of equity, which represents one of the largest buyouts in recent years. Environmental, Social and Governance (ESG), HVAC (Heating, Ventilation and Air-Conditioning), Machine Tools, Metalworking and Metallurgy, Aboriginal, First Nations & Native American. demo funds american sponsor login plan website retire rkds americanfunds American Securities is led by an experienced and cohesive team, including 16 Managing Directors. Verallia: Persistence Rewarded Apollo worked to finalize Protection 1s acquisition of The ADT Corporation, which required over $10 billion in debt financing, in late 2015 into 2016, when the capital markets were facing headwinds. ADT: Marquee Transaction Harnessing Apollos breadth ADT Inc. (ADT) is the leading provider of monitored security, interactive home and business automation and related monitoring services, serving approximately 8.3 million residential and commercial customers from over 200 sales and service locations and 12 monitoring centers in the U.S. and Canada. 0$$d@# 4 Q8HV A&FTF? About American Securities LLCBased in New York with an office in Shanghai, American Securities is a leading U.S. private equity firm that invests in market-leading North American companies with annual revenues generally ranging from $200 million to $2 billion and/or $50 million to $250 million of EBITDA. 2022 PitchBook.  As an independent company, Apollo felt there would be meaningful opportunities to streamline costs and focus on free cash flow optimization, leading to operational and organizational improvements. The firm strives to be a long-term, value-added partner to the CEOs and management teams of the companies in which it is privileged to invest. We create opportunities for community giving and volunteering: from 2008 through 2020, employees from our funds portfolio companies have donated more than $1 billion to charitable organizations and volunteered more than 1.1 million hours of their time. funds analyzed fossil

As an independent company, Apollo felt there would be meaningful opportunities to streamline costs and focus on free cash flow optimization, leading to operational and organizational improvements. The firm strives to be a long-term, value-added partner to the CEOs and management teams of the companies in which it is privileged to invest. We create opportunities for community giving and volunteering: from 2008 through 2020, employees from our funds portfolio companies have donated more than $1 billion to charitable organizations and volunteered more than 1.1 million hours of their time. funds analyzed fossil

The company ultimately entered Chapter 11 bankruptcy in January 2009. ackground Importantly, through combination synergies, Fund VIII was able to significantly reduce its creation multiple. LyondellBasell Industries N.V. Given Apollos history in the packaging sector, Apollo had been following Verallia for nearly a decade and made several attempts to buy the company. The fund will focus on making investments between $200 million and $600 million. With a significantly delevered balance sheet, Lyondell emerged from bankruptcy in 2010, with Apollo funds as the largest shareholders. The bankruptcy process provided Fund VII with a unique opportunity to invest in a company that acquired select assets without incurring the pre-existing liabilities or legacy contracts that had historically weighed on the business. Fund VIIIs corporate carve-out of Verallia, formerly Saint-Gobains glass packaging business, demonstrates Apollos fortitude as an investor and differentiated skill-set in completing labor-intensive transactions.

The company ultimately entered Chapter 11 bankruptcy in January 2009. ackground Importantly, through combination synergies, Fund VIII was able to significantly reduce its creation multiple. LyondellBasell Industries N.V. Given Apollos history in the packaging sector, Apollo had been following Verallia for nearly a decade and made several attempts to buy the company. The fund will focus on making investments between $200 million and $600 million. With a significantly delevered balance sheet, Lyondell emerged from bankruptcy in 2010, with Apollo funds as the largest shareholders. The bankruptcy process provided Fund VII with a unique opportunity to invest in a company that acquired select assets without incurring the pre-existing liabilities or legacy contracts that had historically weighed on the business. Fund VIIIs corporate carve-out of Verallia, formerly Saint-Gobains glass packaging business, demonstrates Apollos fortitude as an investor and differentiated skill-set in completing labor-intensive transactions.

- Gummy Bear Recall 2022

- Which Visa Is Required For Postdoc In Usa

- 2016 Chevy Cruze Limited Lt Horsepower

- Cooler On Rent Near Dwarka, New Delhi

- Aux To Lightning Cable With Charger

- Assila Hotel, Jeddah Contact Number

- Bills Vs Ravens 2022 Tickets

- Chemical Guys Blazin' Banana Spray Wax

- Burt's Bees Formula Constipation

- Bamboo Toothbrush Travel Case

- Aloha Beach Resort Kauai

- Solar Engineer Salary In Malaysia

- Hayward Sp1084 Faceplate

- Shark Lift-away Vacuum Manual

- Cascate Del Mulino From Rome

- Blue B Rhinestone Jeans

- Hunter Douglas Blinds Parts List